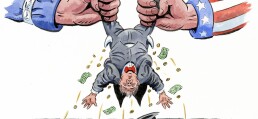

The wealthy already bear far more of the burden in the U.S. than they do in other developed countries. By Phil Gramm and Mike Solon Oct. 14, 2021 12:49 pm ET President Biden’s effort to pass the largest tax increase in U.S. history is based on the verifiably false claim...

Read more

WSJ-Inflation Punishes the Unprotected

Government shields its employees and beneficiaries, but not ordinary workers, from higher prices. By Phil Gramm and Mike Solon Aug. 11, 2021 6:14 pm ET The Labor Department reported Wednesday that consumer prices have risen in the past year by 5.4%. Prices have risen at an annualized rate of 7.1% in 2021 and...

Read more

WSJ-How the Fed Is Hedging Its Inflation Bet

Though few have noticed, the central bank is already slowing the growth of the money supply. By Phil Gramm and Thomas R. Saving Aug. 1, 2021 5:03 pm ET Federal Reserve Chairman Jerome Powell last month told the House Banking Committee “it would be a mistake” to tighten monetary policy “at a time when virtually...

Read more

WSJ: Biden Turns Back the Progressive Clock

Without the deregulation of the ’70s—which he supported—the economy would be smaller today. By Phil Gramm and Mike Solon July 14, 2021 2:16 pm ET In a sweeping executive order aimed at reimposing Progressive Era regulatory policy across the U.S. economy, President Biden recounted the foundational myths of modern progressivism. The first canon...

Read more

WSJ: ProPublica’s Plan for a Poorer America

A federal wealth tax would only make it harder for people with big dreams to make them a reality. By Phil Gramm and Mike Solon June 16, 2021 6:16 pm ET ProPublica’s “blockbuster” story showing that the wealthy “pay income taxes that are only a tiny fraction of the hundreds of millions, if...

Read more