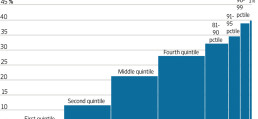

A federal wealth tax would only make it harder for people with big dreams to make them a reality. By Phil Gramm and Mike Solon June 16, 2021 6:16 pm ET ProPublica’s “blockbuster” story showing that the wealthy “pay income taxes that are only a tiny fraction of the hundreds of millions, if...

Read more

WSJ: ProPublica’s Plan for a Poorer America