The Census Bureau’s tallies still don’t include $1.9 trillion in government transfer payments.

House Speaker Nancy Pelosi and Senate Majority Leader Chuck Schumer assured us in July 2021 that expanding the child tax credit would “cut the nation’s child poverty rate in half.” Shortly thereafter, President Biden proclaimed that the expanded credit would “cut child poverty in half this year.” The official census numbers are out, and in 2021 the poverty rate among children under 18 was 15.3%. It fell a mere 0.7 percentage point from 16% in 2020 and was still 0.9 point higher than the pre-pandemic low of 14.4% in 2019, even though government spent an extra $2.6 trillion on transfer payments in 2020-21.

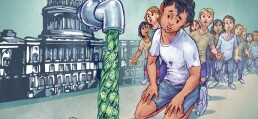

As we pointed out on these pages, the Democrats’ rosy promise wouldn’t be recorded in the official Census Bureau poverty numbers, because the income numbers used to calculate the official poverty rates don’t count refundable tax credits as income to the recipients. No matter how much money the government pours into any of these tax credits, it will never raise the official income measure given the way the census defines income. The omission of refundable tax credits from the official poverty rate calculation isn’t unique. The Census Bureau fails to count two-thirds of all government transfer payments to households in the income numbers it uses to calculate not only poverty levels but also income inequality and income growth. In addition to not counting refundable tax credits, which are paid by checks from the U.S. Treasury, the official Census Bureau measure doesn’t count food stamps, Medicaid, the Children’s Health Insurance Program, rent subsidies, energy subsidies and health-insurance subsidies under the Affordable Care Act. In total, benefits provided in more than 100 other federal, state and local transfer payments aren’t counted by the Census Bureau as income to the recipients.

If the Census Bureau had included the missing $1.9 trillion in transfer payments, child poverty would have been only 3.2% in 2017, compared with the official rate of 17.5%. Government transfer payments that were distributed in 2017 had already cut child poverty by 82%.

The administration has made a lame effort to deflect attention from this structural flaw in the official poverty measure by referencing a so-called supplemental poverty measure. This is one of many experimental efforts to measure poverty using a different method from the official one. This experimental measure shows that poverty for children fell by 4.5 percentage points, from 9.7% in 2020 to 5.2% in 2021. This supplemental rate does count refundable tax credits and some other transfer payments not counted by the official measure, but it still fails to count about half of all transfer payments and significantly overstates the amount of child poverty in America. No matter what supplemental measure the Census Bureau uses to produce the results predicted by Mrs. Pelosi, Mr. Schumer and Mr. Biden, the official measure of poverty, which will be the focal point of debate in future years, won’t record any reduction in the child poverty level from the refundable child tax credit.

Last year, the official census numbers for 2020 failed the laugh test. They showed that household income was down by 2.9% and the poverty rate was up by 1 percentage point in a year when federal transfer payments expanded by 36%. For the first time ever, the Census Bureau included the supplemental estimate in the same release as the official number, showing that income had actually risen by 4% and the poverty rate had fallen from 11.8% to 9.1%. Had it counted all the transfer payments, the poverty rate would have been about 2%.

The official poverty estimate by the Census Bureau not only overstates the level of poverty, but it distorts the policy debate. Politicians use the overstated poverty numbers as a rationale for additional transfer payments. The new transfer payments aren’t counted as household income, so there is no improvement in the official poverty rate. This process is repeated over and over. In the past 50 years the real value of taxpayer funding for transfer payments to the poorest 20% of American households has risen from an average of $9,677 to $45,389.

This vicious circle of deception drives up the deficit and the national debt without solving America’s real poverty problem. Constantly increasing government means-tested transfers doesn’t address the basic needs of the 2% of American households that actually are poor. These households usually suffer from a wide range of dysfunctional conditions that simply can’t be addressed by expanding means-tested transfer payments. Those with severe mental-health problems and drug addiction often never sign up for benefits. Sending payments to those who are no longer poor means that the truly needy, who long ago fell through the cracks in the existing poverty program, continue to be largely uncared for.

The financial burden of federal transfers rose to more than $4.5 trillion annually in 2021. Even before the recent increases, the level of benefits had reduced the percentage of work-age adults in the bottom quintile who actually work from 68% in 1967 to 36% in 2017. At the current level of means-tested benefits, the labor-force participation rate has now fallen in the second and middle quintiles of income earners.

The Bible tells us, “Ye shall know the truth and the truth will make you free.” But the Lord leaves it to us to ferret out the truth. A good start would be for Congress to require that the official Census Bureau numbers reflect reality by including the effects of all transfer payments and taxes.

Mr. Gramm is a former chairman of the Senate Banking Committee and a nonresident senior fellow at the American Enterprise Institute. Mr. Early served twice as assistant commissioner at the Bureau of Labor Statistics. They are the co-authors of “The Myth of American Inequality: How Government Biases Policy Debate.”