The model of tax-rate cuts and deregulation can work again to restore faster growth and lift incomes.

By Phil Gramm and Michael Solon

Aug. 3, 2017 6:51 p.m. ET

A great advantage of having been present when history was made is that later you can sometimes recall what actually happened. Such institutional memory is important today in assessing the 1981 Reagan tax cuts, whose effect is now being relitigated in the debate on the Republicans’ proposed tax reform. To refute claims that the Reagan tax cuts slashed federal revenue, in the words of President Reagan, “well, let’s take them on a little stroll down memory lane.”

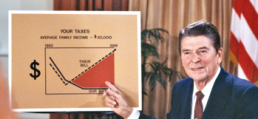

In 1980, the year before Reagan became president, the Congressional Budget Office reported: “During much of the past decade, many taxpayers have found themselves paying larger fractions of their incomes to the federal government in income taxes.” Double-digit inflation in the late 1970s pushed American families into ever-higher tax brackets (there were 15 at the time). This process, called “bracket creep,” drove up taxes almost 50% faster than inflation, enriching the government while impoverishing workers.

Thus even though the 1970s were the postwar era’s weakest decade of economic growth up to that point, federal revenue doubled between 1976 and 1981. Inflation averaged 9.7% during the economic malaise of 1977-80, while government revenue grew by an astonishing 14.8% a year, even as economic growth rates fell steadily and turned negative in 1980.

That same year the CBO estimated that inflation and bracket creep would automatically increase revenue by 2.7% of gross national product by 1985. Today, that would translate into some $500 billion a year—almost eight times as large as President Obama’s 2013 tax increase. But the CBO warned that this would push the tax burden to “an unprecedented level, constituting a significant fiscal drag on the economy.” The CBO humanized the problem by reporting that with the 1980 inflation rate of 13.3%, the tax liability on families of four with incomes between $15,000 and $50,000 (equivalent to roughly $50,000 to $150,000 today) increased by an average of 23%. The poverty rate surged and average family income after inflation dropped by a whopping 8.9%. Just as the CBO predicted, the unprecedented tax burden choked off economic growth, pushing the U.S. into the double-dip recession of 1980-82.

Critics of the Reagan tax cuts today compare the 11.6% growth in federal revenue in 1980, the last year of the Carter administration, with the decline in revenue in 1983. They then declare that the Reagan tax cuts slashed federal revenue. Conveniently missing in that comparison is that the 1980-82 recession, with 10.8% unemployment, reduced federal revenue twice as much as the Joint Committee on Taxation estimated the Reagan tax cuts would in 1982 and 15% more than its estimate for 1983.

What’s more, the expectations of rising revenue during the early Reagan years were based on the assumption that inflation and bracket creep would not let up. In 1981, all public and private economic forecasts predicted continued high inflation. The opposite occurred. As inflation plummeted from the CBO’s projected average annual rate of 8.3% for 1982-86 to an average of 3.8%, revenue compared with projections tumbled $22 billion in 1982 and $70.4 billion in 1983 solely because of reduced inflation and bracket creep. The Joint Committee on Taxation’s static cost estimate of the Reagan tax cuts was $37.6 billion in 1982 and $92.7 billion in 1983. In other words, the collapse of inflation and bracket creep and the double-dip recession caused revenue losses more than twice as big as the projected static cost of the Reagan tax cuts.

The Reagan tax cuts were implemented in three installments, with the top marginal rate falling to 50% from 70%. When the reductions were fully in effect in 1983, the economy snapped out of the recession, and real growth averaged 4.6% for the remainder of the Reagan presidency—more than his much-maligned “rosy scenario” ever promised. In 1984, a final good-government tax provision—indexing individual brackets for inflation and thereby eliminating bracket creep—was implemented. Although indexing reduced revenue, it was overpowered by surging economic growth. Then the 1986 tax reform cut subsidies and special-interest provisions, lowered the top individual tax rate to 28%, dropped the top corporate tax rate to 34% from 46%, and provided additional incentives to work, save and invest.

When Reagan left office, real federal revenue was more than 19% higher than it was the day of his first inauguration. A major recession had been overcome, inflation had been broken, the tax code had been indexed to eliminate bracket creep, and the largest tax cut of the postwar era had been implemented. The Reagan tax cuts and the boom they created stand as the most successful policy initiative and recovery of the postwar era—the polar opposite of Mr. Obama’s program and economy.

The Reagan tax cuts laid the foundation for a quarter-century of strong, noninflationary growth, which, despite three subsequent recessions, averaged 3.4% until the beginning of the Obama administration. And tax revenue was generated by an expanding economy rather than pilfered through bracket creep.

But it wasn’t only the tax cuts, and it wasn’t only Reagan. To his credit, President Carter led the most significant deregulatory effort in the postwar era, reducing the regulatory burden on truckers, railroads, airlines and telecommunications, along with the interest rates paid by financial institutions. Reagan built on this Carter legacy by eliminating price controls on domestic oil and natural gas. These actions enhanced overall economic efficiency and amplified the effects of the 1981 tax cut and the 1986 tax reform.

This history is important because it shows the power of tax cuts and deregulation—exactly the proposals being debated today. The Republican tax-reform program combines the 1981 tax cuts and the 1986 tax reform with a deregulatory effort through legislation, agency rule-making and executive action constituting the most dramatic deregulatory effort since the Carter-Reagan reforms.

Economic growth faded as President Obama raised taxes and smothered the economy with unprecedented regulatory burdens. If we reverse those policies, could we not bring back the Reagan growth rates America enjoyed in the 1980s? Evidence suggests the answer is yes.

Mr. Gramm, a former chairman of the Senate Banking Committee, is a visiting scholar at the American Enterprise Institute. Mr. Solon is a partner of US Policy Metrics.